Drive Safely, Protect Wisely: Demystifying Commercial Auto Insurance

Drive Safely, Protect Wisely: Demystifying Commercial Auto Insurance

Blog Article

Keeping your business operations running smoothly requires careful consideration when it comes to protecting your assets, and commercial auto insurance proves to be an essential aspect. Whether you own a fleet of vehicles for deliveries, transportation, or any other commercial purposes, having the right insurance coverage is crucial. In this article, we will demystify the world of commercial auto insurance, shedding light on its importance, coverage options, and how it plays a vital role in safeguarding not only your vehicles but also your business's overall financial well-being.

When it comes to insurance, we often think about protecting our homes or our lives, but what about our commercial vehicles? Commercial auto insurance provides a vital layer of financial protection for businesses that rely on their vehicles for day-to-day operations. From small startups with a single delivery van to large corporations with an extensive fleet, having the right coverage ensures your business is adequately protected against any unforeseen events on the road.

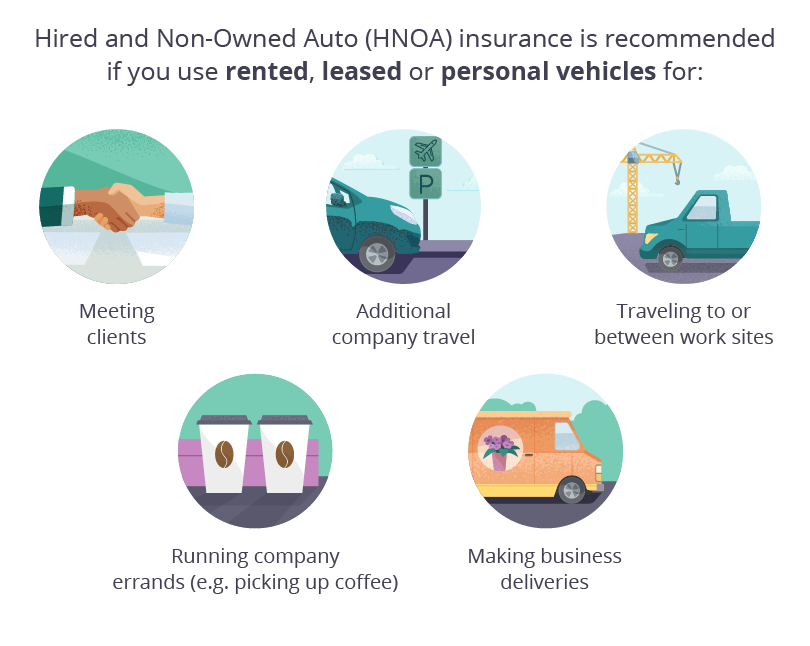

While personal auto insurance may offer some coverage for business-related use of your vehicle, it is essential to understand that commercial auto insurance is distinct and specifically designed to address the unique needs and risks associated with commercial vehicle usage. As the owner or operator of commercial vehicles, it is your responsibility to ensure the safety of your drivers, vehicles, and the passengers or goods they transport. By taking the time to understand commercial auto insurance, you can make informed decisions when selecting the most suitable coverage for your business needs.

Understanding Commercial Auto Insurance

Watercraft and Boat Insurance South Carolina

Commercial auto insurance is an essential coverage for businesses that own vehicles and use them for business purposes. Whether your company operates a fleet of delivery trucks, service vehicles, or even just a single car for business errands, having the right insurance can protect your business financially in case of an accident or damage.

Unlike personal auto insurance, which covers individuals for personal use of their vehicles, commercial auto insurance is specifically designed to provide coverage for vehicles used for business purposes. This insurance can help cover costs associated with accidents, property damage, medical expenses, and even legal fees.

One key aspect of commercial auto insurance is that it offers coverage beyond just the vehicle itself. Apart from collisions and damage caused by accidents, this insurance also provides protection for theft, vandalism, and other non-collision incidents that might occur while the vehicle is being used for business purposes.

By obtaining commercial auto insurance, businesses can safeguard their assets against potential liabilities that may arise in the event of an accident or damage caused by their vehicles. It is important to carefully consider the specific coverage needs of your business to ensure that you have adequate protection for your vehicles and minimize financial risks.

Remember, commercial auto insurance is not the same as home insurance or life insurance. While these insurance types are crucial for personal protection, commercial auto insurance focuses specifically on covering vehicles used for business purposes. By understanding the importance of commercial auto insurance and ensuring that you have the right coverage, you can drive safely and protect your business wisely.

The Importance of Home Insurance

Owning a home is a significant milestone in life, representing stability, security, and a place where cherished memories are made. Just like we protect our loved ones and valuable possessions, it is crucial to safeguard our homes against unforeseen events. This is where home insurance plays a vital role.

Protection Against Natural Disasters: Mother Nature can sometimes be unpredictable, and unfortunate events such as earthquakes, floods, or wildfires can cause substantial damage to our homes. Home insurance provides a safety net, covering the cost of repairs or rebuilding, so we can restore our homes and move forward without financial burden.

Coverage for Theft and Vandalism: Our homes are our sanctuaries, a place where we feel safe and at ease. However, theft and vandalism can disrupt this sense of security. Home insurance offers peace of mind by covering the cost of stolen or damaged belongings, allowing us to replace what was lost and restore the security of our sanctuary.

Liability Protection: Accidents can happen, even within the comfort of our own homes. Home insurance not only protects our physical property but also provides liability coverage in the event that someone gets injured on our property. This coverage can help cover medical expenses, legal fees, and other costs that may arise from such unfortunate incidents.

In conclusion, home insurance is a crucial investment, offering protection and financial security for our beloved homes. From natural disasters to vandalism and accidents, having the right coverage gives us the peace of mind we need to fully enjoy the comfort and sanctuary of our homes.

Ensuring Financial Security with Life Insurance

Life insurance plays a crucial role in ensuring financial security for individuals and their loved ones. It serves as a protective cover by providing a lump sum payment to beneficiaries in the event of the policyholder's death. This financial support can help cover various expenses such as funeral costs, outstanding debts, and ongoing living expenses.

One of the key benefits of life insurance is its ability to provide a safety net for family members, ensuring their financial well-being even after the policyholder's passing. By having a life insurance policy in place, individuals can have peace of mind knowing that their loved ones will be taken care of and can maintain their current standard of living.

Additionally, life insurance can also be used as an estate planning tool. It can help individuals in passing down their wealth to future generations by providing funds that can be used to pay estate taxes or other financial obligations. This ensures a smooth transfer of assets without burdening the beneficiaries with additional financial responsibilities.

Moreover, life insurance policies can also accumulate cash value over time. This feature allows policyholders to access funds when needed, either through loans or partial withdrawals, providing them with a valuable financial resource during challenging times. The cash value component of life insurance adds an extra layer of flexibility and serves as a potential asset for policyholders.

In conclusion, life insurance is a vital component of financial planning that offers a wide range of benefits. It safeguards the financial future of loved ones, allows for effective estate planning, and can provide cash value access. By understanding the importance of life insurance, individuals can make informed decisions to ensure the long-term financial security of themselves and their families.

Report this page